Zenmoney

We live in a world of consumers: everyone is after our wallet. Yet we’re not always able to evaluate the way our financial decisions influence our future life.

Cost / License

- Freemium (Pay once or Subscription)

- Proprietary (GPL-3.0)

Application types

Platforms

- Android

- iPhone

Features

- Bank integration

- Expense Tracking

Zenmoney News & Activities

Recent activities

waypointbudget1 added Zenmoney as alternative to Waypoint Budget

waypointbudget1 added Zenmoney as alternative to Waypoint Budget- updated Zenmoney

adam-rogers376 added Zenmoney as alternative to Online Receipt Maker

adam-rogers376 added Zenmoney as alternative to Online Receipt Maker saulmm2 added Zenmoney as alternative to Kib - Smart Expense Tracker

saulmm2 added Zenmoney as alternative to Kib - Smart Expense Tracker SpreadsheetsHub added Zenmoney as alternative to SpreadsheetsHub

SpreadsheetsHub added Zenmoney as alternative to SpreadsheetsHub thebudgetingapp added Zenmoney as alternative to The Budgeting App

thebudgetingapp added Zenmoney as alternative to The Budgeting App benni347 added Zenmoney as alternative to Today's Budget

benni347 added Zenmoney as alternative to Today's Budget

What is Zenmoney?

We live in a world of consumers: everyone is after our wallet. Yet we’re not always able to evaluate the way our financial decisions influence our future life.

Zenmoney will give you a feeling of security and confidence in your judgment abilities. We will help you make the decisions that will change your life to the best. ———

Why should you choose Zenmoney:

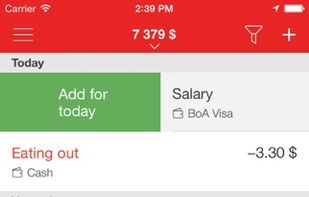

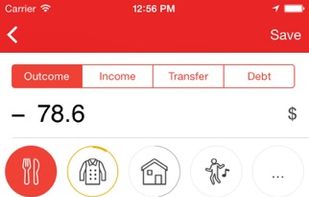

- Automatic tracking of expenses! The app recognizes text messages and automatically creates transactions.

- The apps are available on two platforms. The data is synchronized across the platforms.

- The full-featured domestic accounting is accessible via different logins.

This service runs since 2010. New releases come out every month. We have over 200 thousands registrations, over 10 thousands active users.

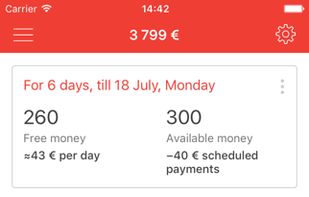

The app shows: — The general overview of your finances: cash, checking, credit cards, loans, deposits. — Where your money goes. — How much money is available, and how much money should be put aside to pay the bills. — Money you owe others, and money others owe you.

Zenmoney is more than just private accounting: it’s a financial assistant that gives you the right guidance at the right moment.

The app helps you to: — Manage your domestic economy. Plan and monitor the family budget. Divide the accounts into personal accounts and joint accounts. — Analyze your earnings and expenses through the specification of your transactions. The system of context-dependent reports will help you always stay within the green zone. — Plan your payments and incomings. — Predict your expenses for the future fiscal periods. — Keep debt accounting.

Comments and Reviews

Plugins for bank synchronization are open source, so it's easier to add new one.

Awesome Support of PrivatBank and Monobank in Ukraine

Pretty good mobile application.