Budget5S

Like

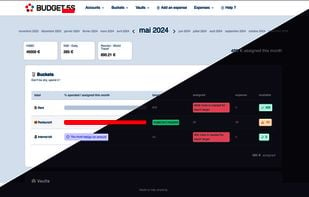

Budget5S aims to offer a free alternative to budget managers. This is an alpha version, with new features to come, changes to be made, and, ESPECIALLY, bugs to be fixed, so it's for informed users. You've been warned!

Features

Properties

- Privacy focused

Features

- Dark Mode

- Ad-free

- No Tracking

- Expense Tracking

Tags

Budget5S News & Activities

Highlights All activities

Recent activities

POX added Budget5S as alternative to Savvy Expense Pro

POX added Budget5S as alternative to Savvy Expense Pro POX added Budget5S as alternative to Am I Good?

POX added Budget5S as alternative to Am I Good?- POX added Budget5S as alternative to Budget Board

POX added Budget5S as alternative to Wally Expense Tracker

POX added Budget5S as alternative to Wally Expense Tracker OpenSourceSoftware added Budget5S as alternative to My Assets+

OpenSourceSoftware added Budget5S as alternative to My Assets+ OpenSourceSoftware added Budget5S as alternative to Smart Wallet

OpenSourceSoftware added Budget5S as alternative to Smart Wallet

Budget5S information

No comments or reviews, maybe you want to be first?

What is Budget5S?

Budget5S aims to offer a free alternative to budget managers. This is an alpha version, with new features to come, changes to be made, and, ESPECIALLY, bugs to be fixed, so it's for informed users. You've been warned!

There are 3 components/mechanics:

- Account: Your bank account or piggy bank with an initial balance.

- Bucket: A bucket, as its name suggests, is for defining a budget. For example, a “Restaurant” bucket can be defined with a monthly amount to be reached, or on the contrary, without an amount depending on the importance of the bucket to keep flexibility. A “Restaurant” bucket can afford to be without an amount, while a “Rent” bucket will have to have a fixed monthly amount (or at your own risk 😉).

- Vault: To build up your financial security or for other specific needs, you can either define it as a monthly requirement without worrying about the total amount (e.g., I want to save €100 every month) or with a predefined total amount (I want to save €10,000 by the end of the year). The amount required to reach this goal will be calculated and displayed for each month. Vaults are linked to an account, which is important for transfers, as you will see below.

To manage your accounts, buckets, and vaults, you can:

- Make a transaction on your account, to remove or add money with a label (for example: Salary - €2,500) or even to notify an unexpected money transfer, for example, if you're giving money to a relative and there's no bucket or vault for it.

- Transaction vaults: If you want to transfer money to your vault, the “transaction vaults” will ask you from which source account to withdraw the money, for which vault. The operation will be recorded in the vault, and the money from the source account will be transferred to the account linked to the vault!

- And finally, you have the expenses. The goal is simple: you indicate the account that you have used, the bucket in which the expense belongs (Restaurant, rent, shopping, etc.).