SimulAr

SimulAr is a Monte Carlo simulation software designed to analyze and evaluate business situations and taking decisions under a risk context. Risk analysis is a technique used to help decision-makers to evaluate a problem under uncertainty conditions.

Cost / License

- Free

- Proprietary

Platforms

- Windows

- Microsoft Office Excel

Features

- Excel Add-in

SimulAr News & Activities

Recent activities

SimulAr information

What is SimulAr?

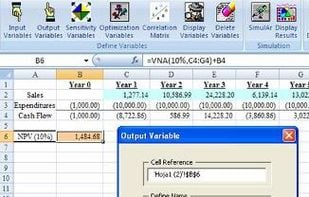

SimulAr is a Monte Carlo simulation software designed to analyze and evaluate business situations and taking decisions under a risk context. Risk analysis is a technique used to help decision-makers to evaluate a problem under uncertainty conditions. In that context, to obtain the closer possible result in comparison to what will happen in the future is indispensable when you are making an economic evaluation. According to this point, it is necessary to appeal to methods that consider and quantify the risk. Nowadays, a great number of managers, business analysts and MBA students, use spreadsheets to develop their models or to evaluate their projects. SimulAr is a program developed as a complement of Microsoft Excel (Add-in) and it is characterized by their simplicity and flexibility allowing the user to handle in a well-known environment.

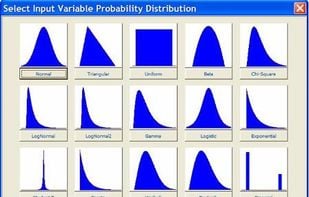

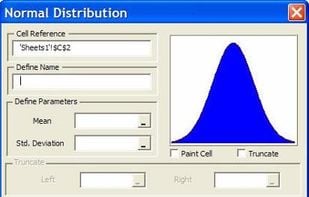

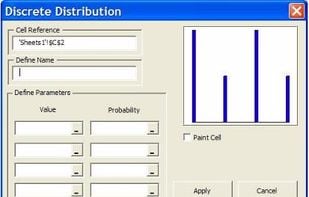

SimulAr focuses in the method denominated "Monte Carlo Simulation" to make a risk analysis. This method consists on assigning probability distributions to model variables that involve risk and then generating random numbers based on those distributions in order to simulate the behavior the modeled problem will have in the future. By this way, it is possible to obtain more realism and reliable results when making decisions.

Traditionally, risk analyses were made studying static and one-dimension scenarios (for example, a pessimistic scenario, a more likely scenario, and an optimist scenario) predicting only one result when sensitizing the variables. SimulAr allows the user thoroughly complete this study incorporating dynamism to the model obtaining not only extreme values but also all those scenarios that are in between. This allows, for example, estimating the probability that an investment project has a net present value greater than zero. Montecarlo Simulation in Excel

Decisions under uncertainty conditions

Developed by Luciano Machain - Copyright 2010