Deriscope

Pricing and risk management of financial derivatives.

Cost / License

- Subscription

- Proprietary

Platforms

- Windows

- Self-Hosted

Features

- Risk management

- Excel Add-in

- Live Feed

- Online Banking

Deriscope News & Activities

Recent activities

Deriscope information

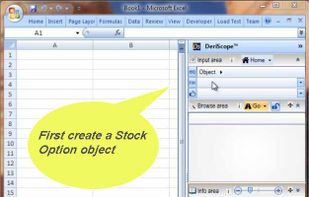

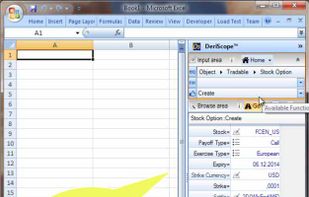

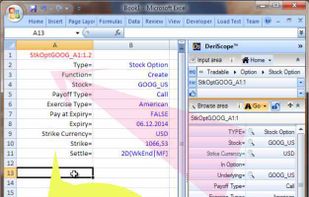

What is Deriscope?

Deriscope is an application specializing in financial derivatives valuation. It draws on QuantLib's analytical power to calculate the price, risk and various other properties of all the financial instruments listed under Coverage. It also makes use of a QuantLib extension called ORE, sponsored by Quaternion Risk Management for pricing instruments not available in QuantLib and calculating portfolio analytics such as VaR and XVA. It comes with an Excel-integrated wizard - the first of its kind in the financial industry - that helps you create spreadsheets with real time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options etc. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. With regard to portfolio risk management, it already calculates the Value at Risk and will soon deliver several XVA metrics. Its user interface facilitates data input by supplying instrument definitions filled with typical values that you may replace with your own custom data. It also significantly simplifies the process of spreadsheet construction through an included spreadsheet generation tool. Finally, if integration with a company's other processing systems is desired, Deriscope may be accessed without Excel's intervention through xml-based data exchange.