ValueEQ

ValueEQ is a Business Valuation Software 2.0 built for finance professionals who need instant access to institutional-grade data and tools without the inefficiency of legacy solutions.

Cost / License

- Subscription

- Proprietary

Platforms

- Online

Features

Tags

- business-valuation-calculator

- monitoring-and-evaluation

- finance-software

- value-investing

- finance-fintech

- Evaluation

ValueEQ News & Activities

Recent activities

- briceP added ValueEQ

briceP added ValueEQ as alternative to Company Valuation Application and PitchBook

briceP added ValueEQ as alternative to Company Valuation Application and PitchBook

ValueEQ information

What is ValueEQ?

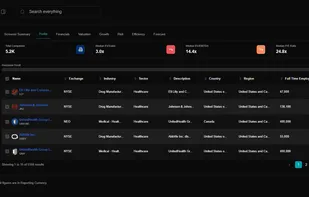

ValueEQ is an AI-powered valuation platform built for finance professionals who need instant access to institutional-grade data and tools without the inefficiency of legacy solutions. With 60,000+ public company comps, 60,000+ M&A deals parsed daily, and an end-to-end suite of valuation tools (WACC, DCF, multiples, and more), ValueEQ empowers analysts, consultants, and investors to deliver insights with speed, accuracy, and defensibility.

The Problem with Traditional Platforms

- Outdated Data: Legacy tools often rely on quarterly updates or delayed reporting, leading to stale comparables.

- High Costs: Platforms like Capital IQ or PitchBook lock users into inflexible contracts costing tens of thousands annually. -Fragmented Workflows: Analysts juggle multiple tools (Excel add-ins, databases, and manual data cleaning) just to produce a defensible valuation.

- Slow Turnarounds: In deal-making, time is money — but traditional methods force analysts to spend hours gathering and validating comps.

Result: Finance teams lose time, increase error risks, and pay too much for tools that don’t keep pace with today’s speed of business.

ValueEQ’s Solution

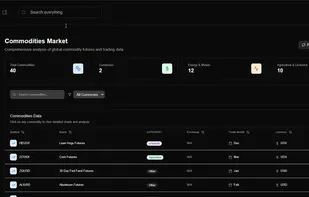

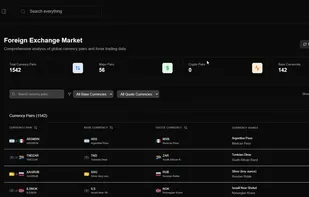

ValueEQ is designed as the modern alternative: one integrated workspace where all valuation tasks can be completed seamlessly. It combines global datasets, AI-driven parsing, and analyst-friendly workflows to ensure results are faster, cleaner, and compliant with International Valuation Standards (IVS).

Key Differentiators:

- AI-Powered Insights – Natural language queries (“Find SaaS acquisitions in Europe under €200m”) return clean comp sets in seconds.

- Global Coverage – 120+ countries, 70+ exchanges, and tens of thousands of private & public comps.

- Real-Time Deal Flow – M&A transactions parsed within hours of filing, with multiples extracted and normalized.

- Valuation Workflows – WACC calculators, DCF engines, DLOM models, and report generators in one place.

- Flexible Pricing – Solo plans at €99/mo and team plans at €240/mo — up to 90% cheaper than legacy competitors.

Core Features in Depth

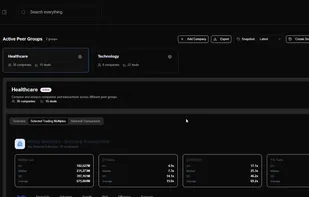

- Trading Comps & Screening

- Access 60,000+ global listed companies.

- Search via filters or plain English AI queries.

- Save peer groups at different valuation dates.

- Export instantly to Excel.

Impact: Analysts save 65% of time compared to manual comp gathering.

- M&A Intelligence

- 60,000+ deals parsed and updated daily.

- Multiples automatically cleaned and IVS-compliant.

- Two-hour latency from filing to platform availability.

Impact: Stay ahead of competitors with fresher, cleaner deal data.

- Valuation Suite

- WACC Navigator: Automated capital cost estimates.

- DCF Models: From inputs to enterprise/equity value in minutes.

- Multiples Override: Adjust comps with custom assumptions.

- DLOM Models: Restricted stock studies and Finnerty models included.

Impact: Complete end-to-end valuations without leaving the platform.