Usefirst

Improve your financial health and grow wealth with Usefirst. No need to open a new bank account. You can simply connect your current accounts.

Cost / License

- Freemium (Subscription)

- Proprietary

Platforms

- iPhone

- iPad

Usefirst

Features

- Financial reporting

- Save money

- Money Tracking

Usefirst News & Activities

Recent activities

Usefirst information

What is Usefirst?

Improve your financial health and grow wealth with Usefirst. No need to open a new bank account. You can simply connect your current accounts.

• Hard to start saving? • Do you want to live financially healthier? • Lose money on unwanted subscriptions that you may even forget about? • Don't know when you can be worth $1 million?

It’s a simple and helpful money management app, savings habit coach, expenses tracker, budgeting app, subscription detection and cancellation service. Usefirst not only helps you start saving, but it’s also a friend that suggests you on how your financial well-being can be improved. It uses machine learning (AI) to discover the hidden potential of your money.

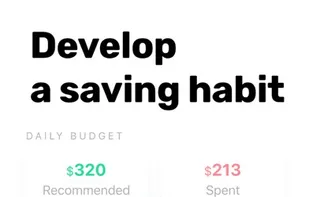

See how much money you can spend today to achieve your savings goals by the end of the month. Usefirst helps you build a savings habit consistently and effortlessly. It unites psychological, sociological and technological approaches to help you get on the path of wealth.

Usefirst can determine the future wealth of a user after following several steps. First, the user connects its bank accounts and the app analyzes the transactions and financial behavior to improve the future financial health. To predict the future income of a user, the app forecasts a future inflation rate as well as a net gap-by gender income change rate, a net income-by-age change rate and other indicators. The app also predicts how the assets to liabilities balance will change over time. It includes the financial and non-financial assets and liabilities the users will probably have in the future. Finally, the algorithm predicts thousands of future scenarios regarding how the future net worth of the users will change. However, the app will display only the best-suited three to five possible scenarios.