SMARD

SMARD is an advanced automated trading software specifically designed for crypto traders and individual investors. Utilizing sophisticated algorithms, SMARD enables users to leverage market fluctuations and execute trades with precision, ultimately aiming to generate substantial...

Cost / License

- Subscription

- Proprietary

Platforms

- Online

Features

- Algorithmic trading

- Bitcoin-trading

- Automated Trading

SMARD News & Activities

Recent activities

primetradingbot added SMARD as alternative to Prime Spot DCA Trading Bot

primetradingbot added SMARD as alternative to Prime Spot DCA Trading Bot jellydator added SMARD as alternative to Jellydator

jellydator added SMARD as alternative to Jellydator

SMARD information

What is SMARD?

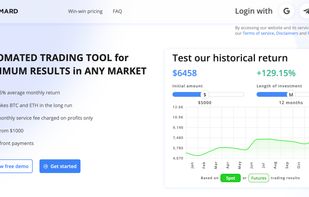

SMARD is an advanced automated trading software specifically designed for crypto traders and individual investors. Utilizing sophisticated algorithms, SMARD enables users to leverage market fluctuations and execute trades with precision, ultimately aiming to generate substantial profits by taking advantage of the inherent volatility of digital assets. The software's main objective is to provide users with a simple yet effective method to enhance their trading performance without requiring in-depth technical analysis or constant monitoring of the market.

How does SMARD work? The SMARD algorithm is based on the momentum effect strategy verified by fundamental literature, as well as a number of tried-and-tested techniques to increase trading performance, which allows SMARD to systematically identify future market winners.

SMARD works with clients via API keys on the Binance exchange to create a secure connection to the software. With this approach, all funds remain in the user's personal account and are fully under their control. Also, the software does not ask you to pay or link your card upfront. The first fee will be due one calendar month from the start of trading, and the amount will be 10% of the profits only.

Minimizing risk with SMARD Risk management is crucial in any trading endeavor, particularly in the highly volatile cryptocurrency market. SMARD incorporates risk-minimization strategies to ensure the safety of user investments. By utilizing stop-loss orders, trailing stop and intricate risk assessment mechanisms, SMARD actively works to shield users from significant losses. This approach, when combined with the software's ability to identify profitable trading opportunities, offers users a balanced and secure trading experience.