Olomon

Even with highly capable advisors—accountants, attorneys, and wealth managers—many successful individuals and families struggle with fragmented financial lives. Assets live in one system, liabilities in another, entities in separate portals, and critical documents scattered...

Cost / License

- Subscription

- Proprietary

Application types

Platforms

- Online

- Software as a Service (SaaS)

Features

Properties

- Privacy focused

Features

- Ad-free

- End-to-End Encryption

- Import CSV Data

- Goal Tracking

- Multiple Account support

- Bank integration

- Cash Flow Analysis

- Dark Mode

- Real time collaboration

- Money Tracking

- Balance Sheet

- Taxes

Olomon News & Activities

Recent activities

Olomon added Olomon as alternative to Copilot: Track & Budget Money

Olomon added Olomon as alternative to Copilot: Track & Budget Money Olomon added Olomon as alternative to Quicken Simplifi and Microsoft Money

Olomon added Olomon as alternative to Quicken Simplifi and Microsoft Money- Olomon added Olomon

- POX updated Olomon

Olomon information

What is Olomon?

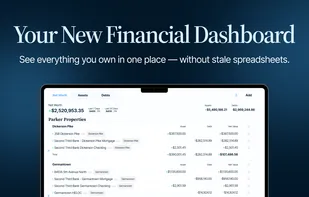

Even with highly capable advisors—accountants, attorneys, and wealth managers—many successful individuals and families struggle with fragmented financial lives. Assets live in one system, liabilities in another, entities in separate portals, and critical documents scattered across inboxes and folders. Advisors often operate with incomplete information, not because of a lack of expertise, but because of a lack of shared context.

Olomon was built to solve this problem.

Personal finance has long been managed with tools that don’t reflect how life actually works. Traditional platforms force financial data into rigid categories, while real financial decisions happen through projects—selling a business, buying or renovating a home, managing real estate, restructuring debt, planning for children, or preparing a legacy. Each project cuts across accounts, entities, documents, and advisors, yet no single system brings it all together.

Olomon is a next-generation personal finance and wealth platform built around a live Personal Financial Statement—a unified, always-current view of assets, liabilities, entities, documents, and relationships. Beyond reporting, Olomon adds critical context: who owns what, how it’s structured, where it lives, why it exists, and who supports it.

Unlike budgeting apps, spreadsheets, or advisor portals, Olomon is designed as a system of record for a financial life, not a static snapshot. It gives individuals and families a clear source of truth while giving advisors the visibility needed to collaborate effectively—without relying on outdated data or disconnected tools.

As the platform has evolved, Olomon’s approach has remained intentional. It began with the foundation of a live balance sheet, expanded to include entity management, document intelligence, and relationship mapping, and now reflects the reality that finance is collaborative and project-based. The result is a platform that organizes complexity while aligning the people involved around shared understanding.

At its core, Olomon exists to replace fragmentation with clarity, static views with living systems, and reactive decisions with confident, informed action. It is built for families, entrepreneurs, and the advisors who support them—so everyone operates from the same source of truth.

Because clarity isn’t just a financial advantage. It’s how families are protected. It’s how teams work better together. And it’s how legacies are built with intention.