GreeksLab

GreeksLab is a powerful no-code platform designed to help traders backtest and optimize their 0dte SPX options trading strategies with precision and ease.

Cost / License

- Freemium (Subscription)

- Proprietary

Platforms

- Online

GreeksLab

Features

- Algorithmic trading

- Options trading

Tags

- trading-analysis

- finances

GreeksLab information

What is GreeksLab?

Build, Test, and Refine Options Strategies — Without Code

GreeksLab’s visual strategy builder lets you create and backtest sophisticated options strategies with precision — no coding required. Design iron condors, butterflies, straddles, or fully custom multi-leg positions with complete control over entry timing, strike selection, and position sizing.

Simulate real-world trading scenarios using powerful management rules that respond to both market conditions and your portfolio state.

Analyze backtest results across 15+ dimensions — from time of day and volatility to DTE and position delta. Dive into detailed performance analytics including Sharpe ratio, max drawdown, win rate, and profit factor to fully understand your strategy’s risk-return profile.

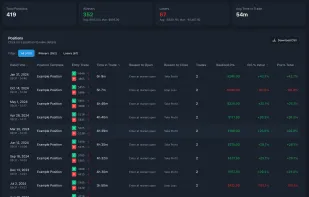

Compare strategies side by side, and review every trade with full context: entry/exit prices, Greeks at execution, P&L attribution, and market data at the time of trade.

Powered by 1-minute resolution data, GreeksLab helps you confidently build strategies that are robust, data-driven, and ready for the real world.