Compliancely

Compliancely is a real-time business verification, compliance, and credit risk platform for lenders, banks, fintechs, insurers, and payments.

Cost / License

- Subscription

- Proprietary

Platforms

- Online

- Software as a Service (SaaS)

Features

- Address verification

Tags

- saas-for-business

- Software as a Service

- Identity verification

- B2B

- Api

- kyc

- tax-compliant

- Automation

- anti-money-laundering-aml

- real-time

Compliancely News & Activities

Recent activities

Complaince12345 added Compliancely as alternative to iDenfy

Complaince12345 added Compliancely as alternative to iDenfy- Complaince12345 added Compliancely

Complaince12345 added Compliancely as alternative to Sumsub

Complaince12345 added Compliancely as alternative to Sumsub- POX updated Compliancely

Compliancely information

What is Compliancely?

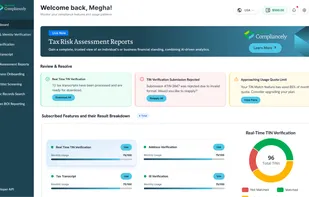

Compliancely is a real-time business verification, compliance, and credit risk platform built for lenders, banks, insurers, fintechs, and payments teams that need to approve, underwrite, and monitor customers at scale. Delivered via API and a no-code dashboard, Compliancely unifies identity, TIN/KYB/KYC, address & SoS registries, sanctions screening, tax transcripts, and ongoing monitoring so you can cut manual review, keep SLAs, and stay audit-ready without juggling multiple vendors.

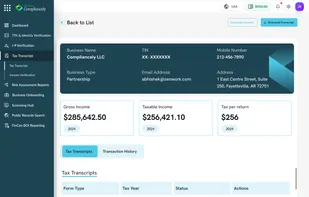

Under the hood, Compliancely is three products in one. Verify runs instant checks TIN/name match (IRS), business verification (SoS/registries), KYC, I-9 employment eligibility, address validation, GIIN/FATCA, and on-demand IRS tax transcript pulls. Assess turns verified data into decisioning with Individual & Business Tax Risk Reports, transcript analytics (income history, balances, liens/levies), and pre-built onboarding bundles for businesses or vendors. Monitor keeps you compliant over time with sanctions/watchlists (OFAC, UN, UK, EU, Canada), DMF deceased checks, FATCA, and tax-account change alerts.

Compliancely’s edge is direct-from-source accuracy and speed. Results come straight from authoritative government and primary registries IRS, Secretaries of State, and other official sources reducing false positives and rework. With 1–3s responses, bulk jobs, webhooks, agentic automation, async processing, and 99.99% availability (including provisional matches to bridge IRS/SSA downtime), teams ship fast, scale confidently, and maintain a consistent audit trail for every check.

Replace fragmented point solutions with a single platform that offers broad coverage, TIN & name matching, business and individual verification, watchlists, GIIN/FATCA, tax-exempt and liens, income verification, transcript retrieval & analysis plus expanding global KYB across 40+ countries and UBO/BOI where available. Whether you’re approving merchants, underwriting credit with verified income, or onboarding vendors, Compliancely delivers an end-to-end risk picture that informs limits, pricing, and ongoing reviews.

Proof at scale: powering 75M+ checks and business verification decisions every year for payments, banking, lending, marketplaces, and more.

Get started: Book a demo to see how Compliancely helps you onboard faster, reduce vendor bloat, and strengthen fraud and compliance controls on one platform.